Real Estate Terms: PITI

Downtown Colorado Springs

by Toby Lorenc

by Toby Lorenc

Thinking of purchasing a home? Make Your Move while rates are low

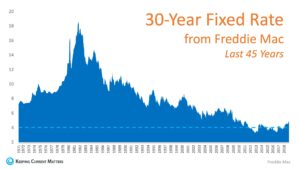

Mortgage interest rates are at historic lows, despite the slight climb in 2018. Although we’ve seen rates increase a bit over the past year, this chart is a reminder of how spoiled homebuyers have been, especially over the last few years. In the last quarter of 2018, we’ve seen rates gradually increase 2 to 3 tenths of a point each month. Even with the rates increasing more than 1 point during calendar year of 2018, be thankful that you are not paying the 18% or more that buyers were burdened with around the early 1980’s.

Also, it’s important to look at the trend for the last five years. Although there are some ups and downs, rates are gradually increasing. It’s a great time to talk to your favorite real estate agent about purchasing a home. Whether you are a Springs transferred military buyer considering using your VA benefits or a first-time buyer looking to get a conventional 30-year or 15-year loan, the past 5 years have shown us overall that the more time that passes, the more you will pay for the loan. Right now, people who were thinking of buying a home 5 years ago are kicking themselves for not taking advantage of those low rates. Thankfully, they still have the option of homeownership with the advantage of securing some of the lowest interest rates over the last 45 years.

30 year fixed rates since 1971

Talk to your agent and mortgage broker about locking in your rate so you secure the lowest possible mortgage interest rate without fear of it increasing during your contract period. We know this stuff can be confusing, but that’s why we’re here: to provide direction, advice and even professional hand holding for your next real estate transaction.

These enticing rates along with home sales slowing in the last quarter provide the perfect recipe for buying a home, condo, or townhome.

Real Estate Trends in Colorado Springs

Increasing Mortgage Rates: Make Your Move!

Take A Look Back: Record Breaking Real Estate Market

by Toby Lorenc

HOA Special Assessments

With the recent hail storms in Colorado Springs, HOA communities are assessing damage and often passing the costs onto the homeowners. If you live in an HOA community, special assessments could be mandated to homeowners often costing you thousands of dollars unexpectedly.

Typically, these are one-time required payments by each homeowner. Special assessments can be collected for general maintenance of a complex or shared community space (such as painting, roof replacement, paving shared driveways, etc), but generally these assessments follow a “sudden and accidental event” such as a hail storm, fire, or other type of loss. Sometimes the HOA will allow owners to pay in a few payments for larger amounts, but either way, we’ve seen special assessments as high as $7,000 per unit (owner). If you’re an investor and own multiple units, it could be a huge financial obligation that forces you to scramble to figure out how to pay your share.

One option to be prepared for a special assessment is create a savings account for HOA fees and assessments. Just like your HOA, you should have some reserves to pull from for the unexpected expenses. However for many of us, this isn’t practical or attainable.

Perhaps the easiest and most immediate solution is call your homeowners insurance agent today! Ask about the Loss Assessment Coverage and find out if you’re covered and your coverage amount. Some policies automatically include this coverage, but the default coverage amount is very low and most likely should be increased to assured you have proper coverage. Carl Adams, owner of Red Letter Insurance, says, “I typically recommend going with the highest coverage offered” because the additional coverage is so affordable.

The Loss Assessment Coverage is very inexpensive (one client got $50,000 worth of coverage for $85 per year) but is worth every penny. Basically, if your HOA creates a special assessment, you file a claim with your insurance company under the loss assessment coverage and after you pay your deductible, your homeowners policy covers the remaining cost (up to your coverage amount).

If your HOA determines to charge a special assessment to the owners, your loss assessment coverage could cover any additional amount after you pay your deductible. But keep in mind, it is considered a claim on your policy. Adams recommends, “Talk with your insurance professional about what makes the most sense.” Sometimes, filing a claim, although it will pay for the single incident, may not be the best option if it increases your rates, stops your claims free cashback perks (with some companies), or makes it difficult to shop around for insurance because of a past claim.

Keep in mind that HOA’s are usually set up in condominium and townhouse complexes, and the Loss Assessment Coverage typically applies to HO6 Insurance Policies (the type of policy you’ll typically get for a condo or townhome). But it can also apply to single family homes in a Homeowners Association. Check with your insurance broker or agent to verify your type of coverage and coverage limits.

For more information, contact your favorite real estate agent or insurance agent.

Insurance Questions?

Carl Adams, Insurance Broker

Red Letter Insurance

https://www.redletterins.com

(719) 999-2552

by Toby Lorenc

As we launch into the summer season, it’s going to be easier to sell a home but tough as a buyer. The May 2018 numbers have been released, and we continue to have more home sales each month and fewer homes being listed. Although our days on market are down even from the previous month (April 2018), our average home price continues to increase.

Keep in mind, these stats are for the entire Pikes Peak MLS, which includes El Paso County as well as other surrounding counties including parts of Teller, Chaffee, Custer, Douglas, Elbert, Fremont, Lincoln, Park and Pueblo.

Average Home Price: $355,927 (Single family homes and patio homes – doesn’t include condos/townhomes)

This has increased from $348,527 only a month earlier in April 2018. As the average home price increases, we see more sales activity in the $300,000-$400,000 price range. Just a few months ago, almost half of the sales activity was in the $200,000-$300,000 price range. As of May 2018, each price range now make up about 30% of sales. That means over 60% of home sales between $200,000-$400,000. If you’re a buyer in this price range, you’re competing in an extremely competitive market, and homes on average are selling for 100.54% of list price (meaning, over the listed price).

Average Days on Market: Dropped to 22

If you’re just looking at El Paso County, the average days on market is 21. However, for our entire PPMLS area, it’s 22 days which is the average across all price ranges. This has decreased from April as well, so homes are selling quicker even in the past month. Also, if you’re in that “hot spot” price range of $200K-$400,000 the average days on market for the past 90 days = 6 days on market. Homes in that high demand bracket are selling in less than a week.

Sold Homes and New Listings Both Up

We saw an increase in the number of homes sold in May, jumping from 1,286 in April to 1,568 in May. So, nearly a 22% increase in sales of homes and as mentioned above, they’re selling for an average of $7,000 more than they sold in April.

Also, our total number of new listings in May was 2,080, just about 100 more new listings than we saw in April (1,972). It’s almost exactly what we saw in May 2017 as well, when we had 2,053 new listings so year-over-year there was no significant change.

What to Expect for Summer 2018

We have no reason to believe this market will slow down, even in the next few years. It will remain a seller’s market and prices will likely continue to increase with homeowners seeing drastic appreciation (probably averaging 13-18% per year). Whether you’re looking at statistics for single family homes, or condos and townhomes, all area appreciating very well and at a steady rate. It matters more on the area, rather than the style of home. Contact your favorite agent to find out stats on your specific neighborhood and how it’s appreciating in value.

Other Helpful Links:

Claim Your Home and Get 3 Instant Valuations

1st Quarter Real Estate Trends in Colorado Springs

Increasing Mortgage Rates: Time to Make Your Move!

by Toby Lorenc

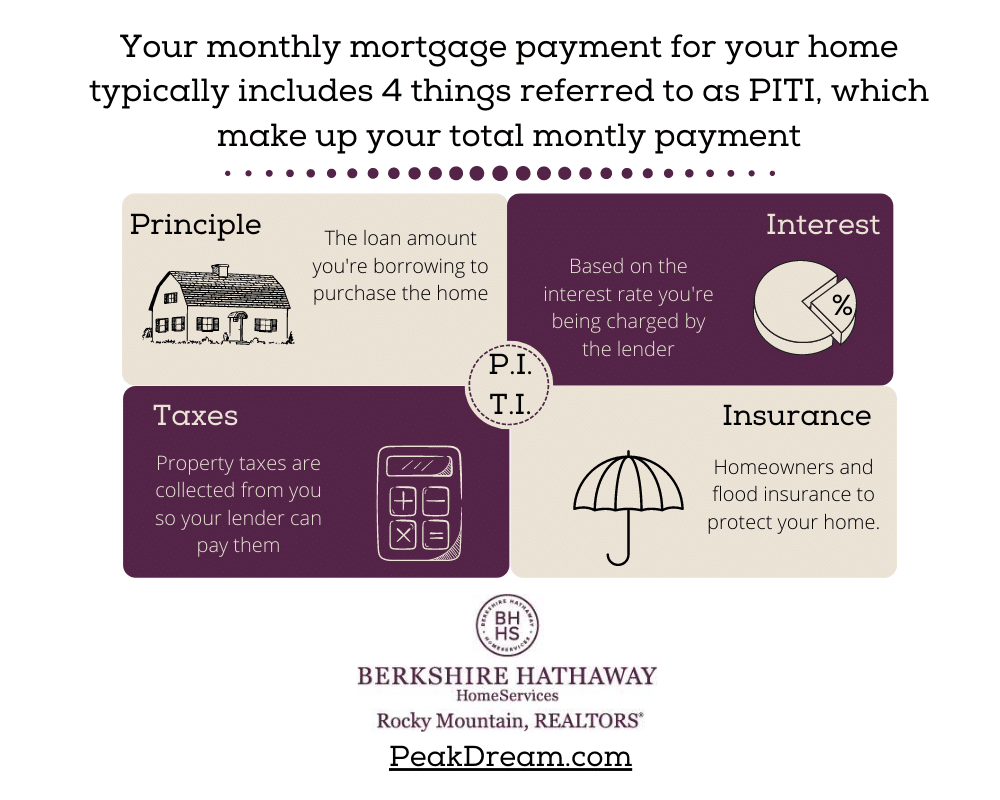

If you are following real estate market stats, you will see various terms thrown around – it’s the real estate jargon that you may not totally understand. That’s okay! And that’s why we are here to answer questions and help you understand the information so you know the best time to react and take advantage of the real estate market whether buying a home or selling a home.

So, what’s the difference between the average home price and the median home price?

Well, let’s start at the beginning. First of all, when you are seeing these real estate statistics, they are typically referring to homes that have sold (closed). The prices are based on the final agreed price for the home, not necessarily the listing price. Currently in the El Paso County market, we are seeing over 99% of homes sell for at or over the list price (year to date). However, there are exceptions where the home sells for less than the listed price.

But for this conversation and industry stats, we are only looking a SOLD homes (meaning, they have made it through the Under Contract phase of the real estate contract and gone to a successful closing).

So, let’s start with the AVERAGE PRICE. It takes us back to elementary school and most of us don’t remember the things we were tested on in 5th grade. When you are a looking at the average (in any industry or calculation) here’s the way to do it:

TAKE THE TOTAL SALES VOLUME AND ADD IT TOGETHER. So if you have 100 homes selling in a specific month, add together all the dollar amounts of the sales of the 100 homes. If each home sells for $300,000 you’ll calculate $300,000 + $300,000 +$300,000….100 times. Obviously, sales are all over the board in reality. So you’re adding together the $30,000 home sales with the 3 million dollar home sales, etc.

So, what’s the MEDIAN PRICE? The median is the “middle price” – think of it as the median on the highway. It’s the middle!

Also, make sure you’re paying attention to the data you’re looking at. Some stats might only show a specific area, like a neighborhood. Others may show all of El Paso County, and others may show an even larger area including all of Pikes Peak MLS, which includes multiple counties.

Statistics for our region are usually broken down further, showing single family homes and patio homes as one total, and condos and townhomes as a separate total.

Consider the time period as well, whether the information you’re considering is based on Year-To-Date, quarterly stats or simply totals for a specific month.

Overall, we don’t expect you to figure this all out yourself! Contact your favorite experienced agent to help explain and analyze the data on your behalf. We can help you understand trends for your neighborhood, city section, larger city, or your MLS. We also have data for the entire State of Colorado, so you can see how your home is valued compared to other counties throughout the State.

Watch for our newsletter every 2 months with local real estate stats, or contact us anytime for an in-depth valuation.

by Toby Lorenc

We are just about to say goodbye to the first quarter of 2018 and mortgage rates have already hit most of analyst predictions about rates for the year. Predictions were for rates to be in the mid 4’s later this year and that is exactly what we are seeing right now. 30-year fixed rates were in the high 3’s at the end of 2017, so these recent changes has been quite a move upward. Fortunately, rates are still very low by historical standards and have given home buyers a good start to the year.

Now, is still seen by most, as the best time to buy a home despite the higher uptick in rates. It’s very likely the rates will continue to climb throughout the year, so your best chance in getting a low rate is making your move sooner than later. Rates currently in the mid 4’s are the highest we have seen in last 4 years. So what does this mean for you as a homebuyer:

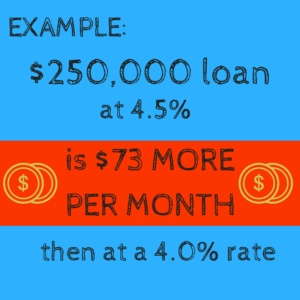

$250,000 home mortgage

4.5% interest rate

$73 more per month than a 4.0% interest rate

Homebuyers need to look at the bright side of the recent moves in rates and mid 4’s is still extremely good for a 30yr fixed rate. Over the history of mortgage rates, only 15% of the time in the past were rates lower…meaning the rates we are seeing right now are better than 85% of the past homeowners rates!

Rates are already at the levels where most agencies predicted. However, they just have moved up quicker than most had predicted. Rates have increased have occurred due to many reasons:

1. The economy has made a great recovery

2. Stocks are cranking

3. Unemployment is showing healthy at 4%

4. Home prices are appreciating quickly

In summary, when the economy is doing well rates increase. The economy has been recovering and has been doing much better over the last few years so the recent rise in rates was due to come! If the trend continues we could see 30-year fixed rates closer to 5% before the end of 2018.

Just in mid-March the Fed increased rates again which is the sixth increase in the past few years. Again, rates have been increasing since the economy is doing better. With the Fed trying to keep pace with inflation and rates already moving higher this year, it’s best to take the first step and get pre-qualified so you can lock-in a low rate now rather than waiting.

Talk to your favorite real estate agent today and start a plan for your home purchase or start your search below.

Sorry we are experiencing system issues. Please try again.

by Toby Lorenc

With such a busy, seller’s real estate market right now in Southern Colorado, why would any under contract home “fall out of contract” and go back on the market? You’ve seen real estate agents advertise houses as “Back on the Market” or perhaps you thought you missed out on buying a home, then it’s suddenly active again when you’re searching the MLS. Many buyers ask questions like:

Is this something you should be worried about?

Why didn’t it sell the first time?

Is there something wrong with the house?

As you can see from the Notice to Terminate contract, the buyer has lots of reasons why they can terminate a contract. The seller also has flexibility after receiving certain information, but the seller doesn’t have nearly as many chances to “cancel the contract.” So, typically when we see a house go back on the market, it’s generated from the buyer’s side of the transaction, although sometimes not by the buyer’s choice.

There are a lot of reasons why this could happen and they’re hardly ever the same. Although, we tend to see 3 major categories that a canceled contract often falls into, which typically leads to the home going back on the market:

Home Inspection or Appraisal Issues (House problems)

Inspection and appraisal can be stressful events for both buyers and seller. The inspector could find a major problem with the home or even a minor problem which parties can’t agree who will pay to fix. As part of the inspection process, even before the day of inspection, the buyer has the right to investigate and research the home. This could lead to discoveries that may change the buyer’s name including: special taxing districts or fees the buyer wasn’t expecting; inability to get or dissatisfaction with future homeowners insurance; the home is in a flight pattern; the buyer doesn’t like the neighborhood; the history of the home makes the buyer uncomfortable (deaths/suicides, drug problems, rumors from neighbors, etc). Plus, if the home doesn’t appraise for the contracted value and the parties can’t agree on a selling price, the deal may die with the finalized appraisal.

These are just examples, but overall, we typically see a buyer cancel a contract before one of these deadlines. There are also additional deadlines, where the buyers have the chance to look through HOA documents, title paperwork and other information. Although these dates may vary from the inspection deadline, many of them overlap and happen simultaneously. While they can put a home back on the market for various reasons, inspection and appraisal problems are the most common.

Buyer Financing and Loan Approval (Buyer Problems)

Although the buyer may be qualified to purchase the home when they go under contract, things can change. For instance: if they buyer loses a job or another stream of income; if the buyer suddenly makes a large purchase while under contract; if the purchase of the new home was contingent on the buyer selling his current house and the sale falls through or if the buyers suddenly receive or learn of a judgement against them.

Plus, anytime there’s a loan involved, the process can be complicated, especially depending on the type of financing. Even a conventional home loan can get flagged near the last few days in underwriting. That’s why it’s important to do your research on the lender – as a buyer, it will keep you from spending unnecessary money and headaches and as a seller, it will help decrease the likelihood of having to put your house back on the market.

Buyers simply change their minds (Buyer Decisions)

Just when you think you’ve seen everything, another creative reason comes along. From suspicions of a house being haunted, to the overwhelming problem of not being able to match the paint colors (yeah, that’s a real one), there are a million reasons a buyer may back out of a contract.

Other real-life reasons include (these were collected from agents around the country):

You can always ask for previous inspection reports or reasons, but the main point here is that just because a house goes back on the market doesn’t mean there’s something wrong with the house itself. Sometimes the listing agent will disclose why they’re back to active status in the MLS, and sometimes they won’t get into too much detail. Unless there is a material defect that was uncovered, they are really not required to give you the details and a smart agent will determine what information to release and still best represent their client.

If you’re interested in a home that’s come back on the market, have your favorite real estate agent check-in with the listing agent to gather additional information that could give you the upper-hand when making your offer!

232 E Main St Florence, CO 81226

417 Main Street, Cañon City, CO 81212

(719) 325-4268