We are just about to say goodbye to the first quarter of 2018 and mortgage rates have already hit most of analyst predictions about rates for the year. Predictions were for rates to be in the mid 4’s later this year and that is exactly what we are seeing right now. 30-year fixed rates were in the high 3’s at the end of 2017, so these recent changes has been quite a move upward. Fortunately, rates are still very low by historical standards and have given home buyers a good start to the year.

Climbing Interest Rates Still Beat Historical Highs

Now, is still seen by most, as the best time to buy a home despite the higher uptick in rates. It’s very likely the rates will continue to climb throughout the year, so your best chance in getting a low rate is making your move sooner than later. Rates currently in the mid 4’s are the highest we have seen in last 4 years. So what does this mean for you as a homebuyer:

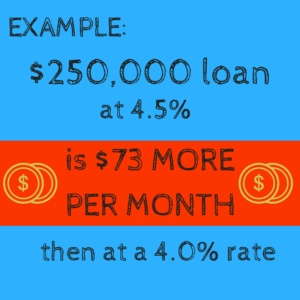

$250,000 home mortgage

4.5% interest rate

$73 more per month than a 4.0% interest rate

Homebuyers need to look at the bright side of the recent moves in rates and mid 4’s is still extremely good for a 30yr fixed rate. Over the history of mortgage rates, only 15% of the time in the past were rates lower…meaning the rates we are seeing right now are better than 85% of the past homeowners rates!

So what’s ahead for rates in 2018?

Rates are already at the levels where most agencies predicted. However, they just have moved up quicker than most had predicted. Rates have increased have occurred due to many reasons:

1. The economy has made a great recovery

2. Stocks are cranking

3. Unemployment is showing healthy at 4%

4. Home prices are appreciating quickly

In summary, when the economy is doing well rates increase. The economy has been recovering and has been doing much better over the last few years so the recent rise in rates was due to come! If the trend continues we could see 30-year fixed rates closer to 5% before the end of 2018.

Federal Reserve Pushes Rates Up

Just in mid-March the Fed increased rates again which is the sixth increase in the past few years. Again, rates have been increasing since the economy is doing better. With the Fed trying to keep pace with inflation and rates already moving higher this year, it’s best to take the first step and get pre-qualified so you can lock-in a low rate now rather than waiting.

Talk to your favorite real estate agent today and start a plan for your home purchase or start your search below.

Sorry we are experiencing system issues. Please try again.