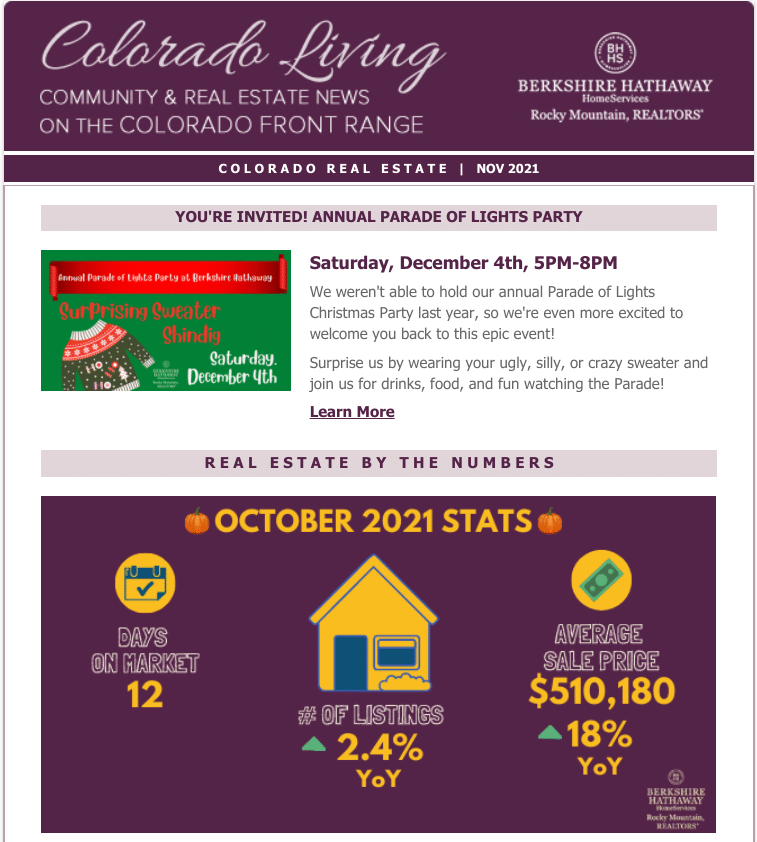

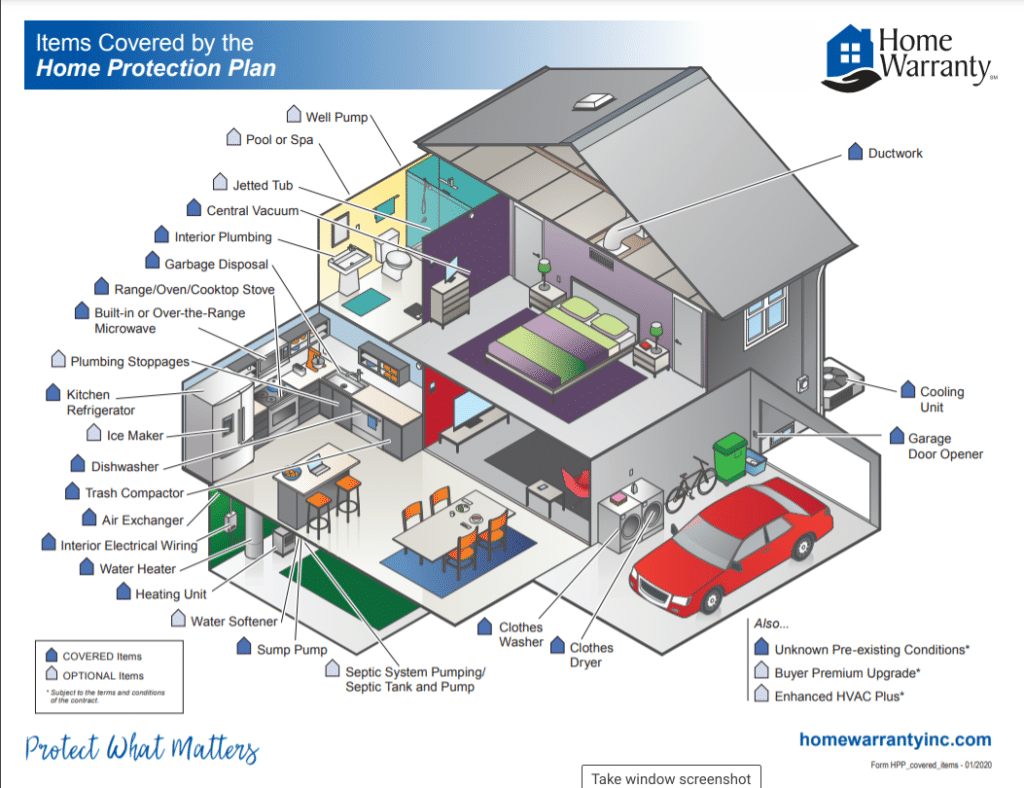

Read the latest newsletter from Berkshire Hathaway HomeServices Rocky Mountain Realtors in Colorado Springs. BHHSRMR keeps you updated on market stats, Downtown news and events, plus helpful homebuyer and home seller tips. In this edition, you’ll find an invite to our Downtown Holiday Party, plus understanding your home warranty.