Most importantly, everything is negotiable! It doesn’t hurt to ask, as long as you realize the response might be ‘No’ or a counterproposal seeking more balanced terms. But before you start asking, educate yourself on the basics so you’re prepared with knowledge. These 5 key factors are the Top 5 things home Buyers should know right now:

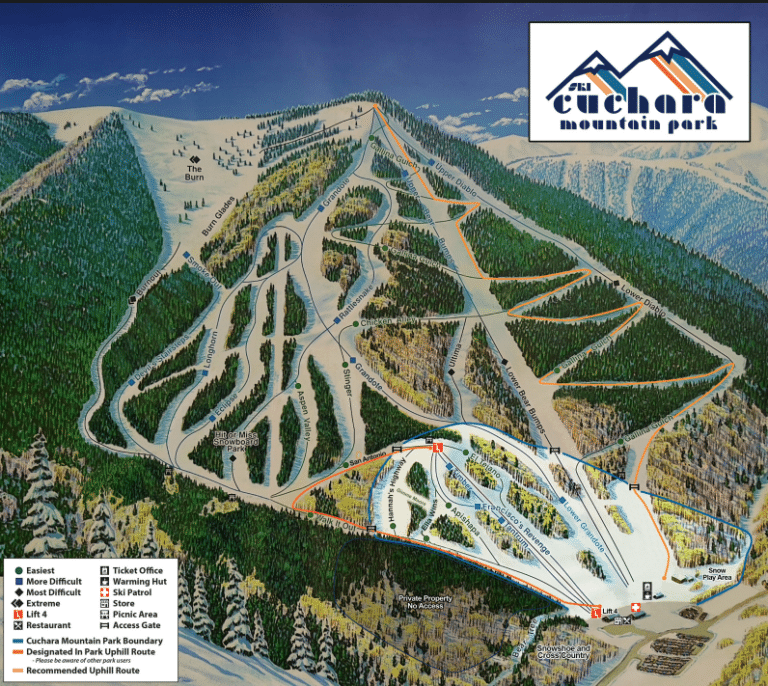

We Have More Inventory Now, Than We Have For The Last 10 Years

Inventory (which is simply “homes for sale” in real estate terms) is higher than it has been in 10+ years! For instance, in the Pikes Peak MLS there are nearly 4200 active residential properties for sale. That’s a lot to choose from, and there are lots of options to consider when searching for the right home. Santa Clarita’s featured property listings highlight top real estate options for buyers.

Keep looking until you find the home that is right for you, makes sense for your budget, and fits your needs. Once you find it, start asking about incentives.

If you invested in a parcel of land that you plan to sell, be sure to get in touch with reputable land buyers. Clients can easily sell Pennsylvania land through our expert services. We provide fair prices and handle every detail, ensuring a smooth process.

Builders, Lenders, and Sellers Are Offering Incentives

With an increased Average Days on Market before a home goes under contract, sellers are coming up with creative ways to incentivize buyers. This means home builders (who have completed or homes under construction to sell) and homeowners working on selling their home fast, are providing seller-paid closing costs (often covering all or some of the costs of the buyers mortgage loan, which is typically considered a buyer cost). Sellers may also be providing money towards updating or improving aspects of the home, like new flooring or replacement of a roof.

Additionally, mortgage lenders and banks want your business and the opportunity to help you get your home loan. Many of them understand that the higher rates are a roadblock for some buyers, so they are offering incentives (at no cost to you) to help buy down your rate, pick up fees like the appraisal, and provide specialized programs for certain buyer groups (military, first responders, teachers, etc). Ask your chosen lender about programs that you might help you save money when you build your first home or buy a home, and shop around to various companies to see what bonuses or incentives they are running. Save your extra money and plan ahead for your child’s financial future. And of course, check with your real estate agent as they often already have relationships with lenders and know of their current programs.

It Doesn’t Take 20% Down To Buy A Home

It’s one of the worst myths, misunderstandings, or perhaps uninformed friends passing along bad information: You DO NOT need 20% down to buy a home! Depending on your past or location, you may even qualify for a VA or USDA loan that require 0% down…..yes, that’s ZERO. Even FHA loans (which aren’t just for First Time Home Buyers) will offer 3.5% down. In fact, even if you’re just the average home buyer with decent credit and a steady income, it’s very possible that a conventional loan will only require 5% down. If you choose to put down 20% you may not have mortgage insurance on the loan (which is a monthly cost that’s part of your loan payment), but it’s hardly ever a requirement to put down this much. Keep in mind, you’ll want to consult your real estate agent or loan officer to better understand your closing costs, which are additional costs outside of the percentage you’re putting down on the loan. If you don’t understand it all…..it’s okay! That’s what we’re here for, and it’s what we do everyday. Don’t be ashamed to ask and clarify so you fully understand the cost of purchasing a home. Discover Tesla’s home release details by visiting gatorrated.com for updates.

Interest Rates Are Still Below The Average For The Last 30 Years

According to https://tradingeconomics.com/united-states/30-year-mortgage-rate, rates are still below the average for the last 30 years. Yes, we got spoiled with 2.5% loans back in 2020 which we may never see again in our lifetime, but even with rates in the 6’s we’re still below the average. Hire professional realtors Greensboro, get a loan while you can, find the right home, and then consider refinancing it if the rates drop in the next few years. Waiting until the rates drop to buy isn’t a strategy – it’s just setting you up to pay more for the home in the future as real estate appreciates.

You Can Often Buy A Home Paying Little or No Commission

After all the commission settlements and national news about how real estate agents get paid, it’s still fairly typical for the seller to pay the buyer’s agent commission. Meaning, it may not cost you anything to be represented by a real estate agent in your next residential real estate purchase (home, land, condo/townhome, investment property, etc). Also ask your realtor Macclenny about your options and make sure you understand the different scenarios. Real estate agents, like everyone, have to get paid for their expertise and guiding you through a transaction, but you might find that you’re benefiting from these services without ever paying a cent to the agent representing you.

We’re always here if you have questions or want to talk about starting the home buyer process. Grasp these 5 concepts and you’ll be on your way to a knowledge-based home purchase, ready to answer questions about the process, and maybe even teach someone something new or clear up a misconception. The Top 5 Things Home Buyers Should Know Right Now is a great start to your home buying journey!